Table of Content

The COVID-19 Refund Modification is designed to give Veterans and their families an opportunity to retain home ownership with a reduced monthly mortgage payment. As with the previously mentioned COVID-VAPCP, VA will establish a second lien for any portion of the loan VA purchased to provide payment relief to the borrower. Veteran borrowers that qualify must have been on a COVID forbearance, occupy the property as a main residence and been within 120 days current on March 1, 2020.

The cost of rule familiarization is $99.90 for each guaranteed loan servicer, including the small servicers. The PRA cost estimates vary across servicers depending on how many COVID-19 forbearance loans they service that either meet or could potentially meet COVID-VAPCP requirements. An internal assessment indicates that approximately half of VA-guaranteed loans in forbearance will reach 360 days of forbearance sometime during the months of May and June of 2021. However, as discussed above, VA has been a part of the coordinated federal response that extends protections for borrowers with federally backed mortgages. Given these additional protections, VA now anticipates that most veterans currently in a COVID-19 forbearance will remain in such forbearance until at least late June 2021.

G. § 36.4806 Terms of the Assistance to the Veteran

If the loan is held by a servicer other than the original lender, provide the refund to the current servicer, and direct the servicer to apply the refund to the principal balance of the loan. Due to the fact that you pay the funding fee directly to the VA, it is the VA that will ultimately decide whether or not you can receive a refund. To begin the refund process, you can either contact your original lender or your VA Regional Loan Center. According to the VA loan handbook, all refund requests must be reviewed and a decision made within 10-business days of the initial request date.

If service was between Sept. 8, 1980, (Oct. 16, 1981, for officers) and Aug. 1, 1990, Veterans must generally complete 24 months of continuous active duty service or the full period for which they were called or ordered to active duty, and be discharged under conditions other than dishonorable. VA averages the sales volumes from Factiva for all servicers considered small, including those primarily considered commercial banks, savings institutions, and credit unions. The servicer must not charge, or allow to be charged, to the veteran any fee in connection with the COVID-19 Veterans Assistance Partial Claim Payment program. VA defines “alternative to foreclosure”, “COVID-19 forbearance”, “COVID-19 indebtedness”, “Guaranteed loan”, “Loss-mitigation option”, “Secretary”, and “Servicer” as set out in the regulatory text below.

V. Effective Date of Final Rule

Veterans who wish to refinance their subprime or conventional mortgage may now do so for up to 100 percent of value of the property. Special Forbearance – The servicer agrees not to initiate foreclosure to allow time for borrowers to repay the missed installments. An example of when this would be likely is when a borrower is waiting for a tax refund. VA loans made on or after March 1, 1988, are not assumable without the prior approval of VA or its authorized agent . To approve the assumption, the lender must ensure that the purchaser is a satisfactory credit risk and will assume all of the Veteran’s liabilities on the loan.

This table of contents is a navigational tool, processed from the headings within the legal text of Federal Register documents. This repetition of headings to form internal navigation links has no substantive legal effect. Document page views are updated periodically throughout the day and are cumulative counts for this document. Counts are subject to sampling, reprocessing and revision throughout the day.

A. General Comments

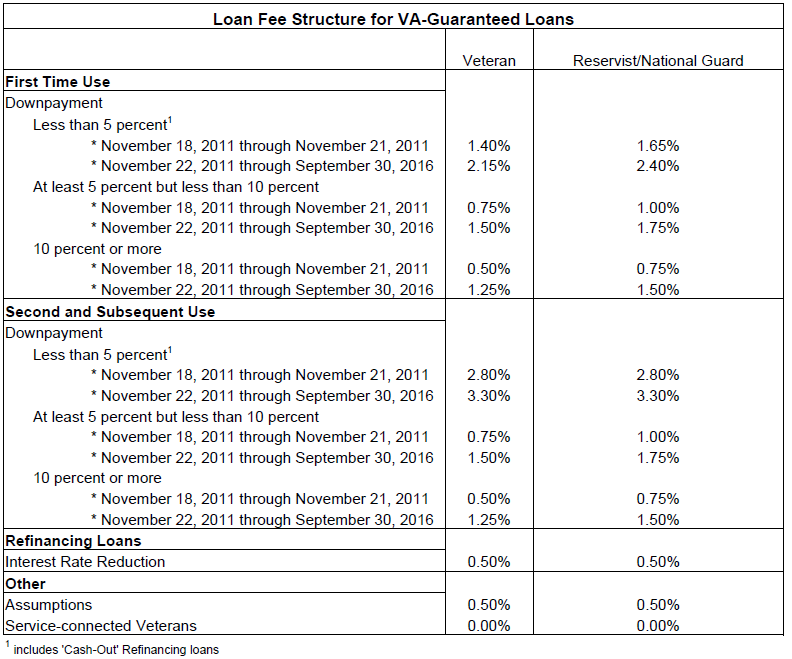

The funding fee is a percentage of the loan amount which varies based on the type of loan and your military category, if you are a first-time or subsequent loan user, and whether you make a down payment. You have the option to finance the VA funding fee or pay it in cash, but the funding fee must be paid at closing time. In paragraph , VA explains that if the servicer miscalculates the partial claim amount, resulting in an overpayment to the servicer, the amount of such overpayment shall constitute a liability of the servicer to the United States. The servicer will be required to remit the overpaid amount immediately to VA. In paragraph , VA states that if the servicer miscalculates the partial claim amount, resulting in underpayment (i.e., an amount insufficient to bring the guaranteed loan current), the servicer must waive the difference. Commenters correctly noted that VA has a longstanding history of not prescribing a required “waterfall” of home retention options.

With the exception of the certifications, most of the information collected and presented on the form will be captured on the note prepared by the servicer and presented to the veteran. VA has further determined that those data elements from the form that may not be included in the note, such as the date of the veteran's next monthly mortgage payment to the servicer, are not critical to the rule and will likely be communicated from the servicer to the veteran in other ways. Of those comments, twelve were from individuals and five were from lenders, servicers, trade organizations, or consumer groups. VA also received one comment co-signed by 27 national- and state-level trade and consumer organizations. Three commenters that joined the joint trade and consumer group comment also submitted their own comment, and VA has arranged those with the five other organizational comments.

If I’m Exempt from the Funding Fee, Why Did I Have to Pay It?

To the extent feasible, issues raised by commenters have been summarized and grouped together by similar topic. On December 9, 2020, VA published a proposed rule to establish a temporary program to assist veterans with VA-guaranteed home loans who request forbearance under the Coronavirus Aid, Relief, and Economic Security Act. The public comment period for the proposed rule closed on January 8, 2021. VA has notified mortgage companies that the missed payments due at the end of a COVID-19 forbearance period do not have to be made up in a single payment.

However, if you can make up the all the payments in a lump sum and resume making regular monthly mortgage payments, then you may do so. This fee helps cover losses in the event a VA loan goes into default and keeps the VA loan program running for future generations of military homebuyers. The funding fee applies to all purchase and refinance loans and is 2.30 percent of the loan amount for most first-time VA borrowers. The amount VA will guarantee on a manufactured home loan is 40 percent of the loan amount or the Veteran’s available entitlement, up to a maximum amount of $20,000. These provisions apply only to a manufactured home that will not be placed on a permanent foundation.

If you paid for it out of your loan proceeds, then your lender will need to refund the amount to your loan balance and submit evidence to the VA that the refund was applied. Veteran borrowers may be able to request relief pursuant to the Servicemembers Civil Relief Act . In order to qualify for certain protections available under the Act, their obligation must have originated prior to their current period of active military service.

If needed, another three-month period should be approved by the mortgage servicer. Although the total forbearance under this paragraph would equal an additional six months, each three-month extension should be requested individually. If you need the additional period, you may notify your mortgage company that you are still experiencing hardship due to the COVID-19 pandemic and request up to 180 additional days of forbearance. As with the initial period of forbearance, you don’t have to use the entire period of forbearance if you can resume payments sooner. In the home loan context, a forbearance usually means a time period during which your mortgage company agrees to accept reduced payments or no payments on your loan.

For reasons discussed immediately below, VA also believes the 60-day timeframe will not cause undue harm to veterans. Upon reviewing the comments, and in consideration of VA's decision to eliminate interest charges and the ten-year repayment term, VA is finalizing the rule with requirements more aligned with FHA's COVID-19 Standalone Partial Claim program. Both commenters pointed out that VA's own example in the proposed rule resulted in a 20 percent monthly payment increase at year six. Citing lessons learned from the 2008 financial crisis, these commenters noted that the repayment structure utilized by FHA and USDA avoids payment shock. In paragraph , VA clarifies that servicers shall not include any amounts in the partial claim that are not listed by paragraph or .

VA is also concerned that mandating the partial claim option could increase upfront costs for some servicers, which could in turn impede them from helping the veterans they would otherwise be able to serve. The COVID-19 Refund Modification is intended for those borrowers that have not been able to recover from the pandemic to the same financial income level as prior to the pandemic. Those Veteran borrowers would be able to afford regularly scheduled monthly mortgage payments but not at the pre-pandemic amount.

No comments:

Post a Comment