Table of Content

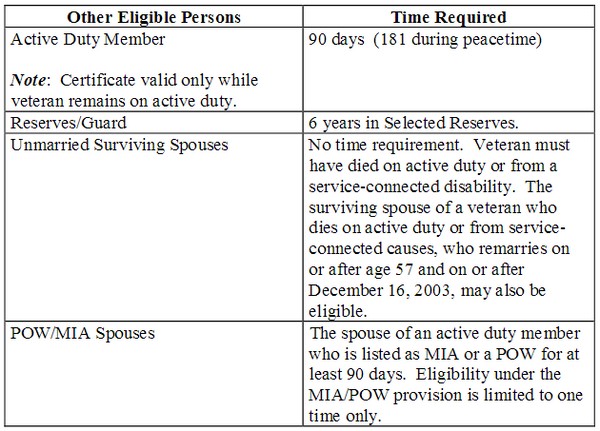

Native American Direct Loans are only available if a memorandum of understanding exists between the tribal organization and VA. Repayment Plan – The borrower makes a regular installment each month plus part of the missed installments. You are not allowed to pay for the termite report, unless the loan is a refinance. Even if you are sure that you are eligible for one of these refunds, it could take months for you to receive it. The VA Loan Guaranty Service has drafted a plan to begin issuing refunds to the remaining 53,200 eligible Veterans, and they aim to implement that plan by July 31, 2019. General requirements of the COVID-19 Veterans Assistance Partial Claim Payment program.

The fees were charged through the VA's Loan Guaranty Program and ranged from $5,000 to $20,000, according to the audit, released in June. VA loan managers reportedly knew vets were being improperly charged since 2014 but didn't do anything about it, VA IG auditors said. Find out if you can get a Certificate of Eligibility for a VA-backed or VA direct home loan based on your service history and duty status. You’ll pay this fee when you close your VA-backed or VA direct home loan. Yes, state and local programs are taking applications from renters and landlords to distribute money from the U.S.

Information for VA home loan borrowers during COVID-19

Department of Treasury’s Emergency Rental Assistance program in their own communities. The money can help landlords and renters who are struggling to keep up with rent and other bills. 360 months , as long as the extension is 120 months or less from the original maturity date on your mortgage note. A VA approved lender; Not endorsed or sponsored by the Dept. of Veterans Affairs or any government agency.

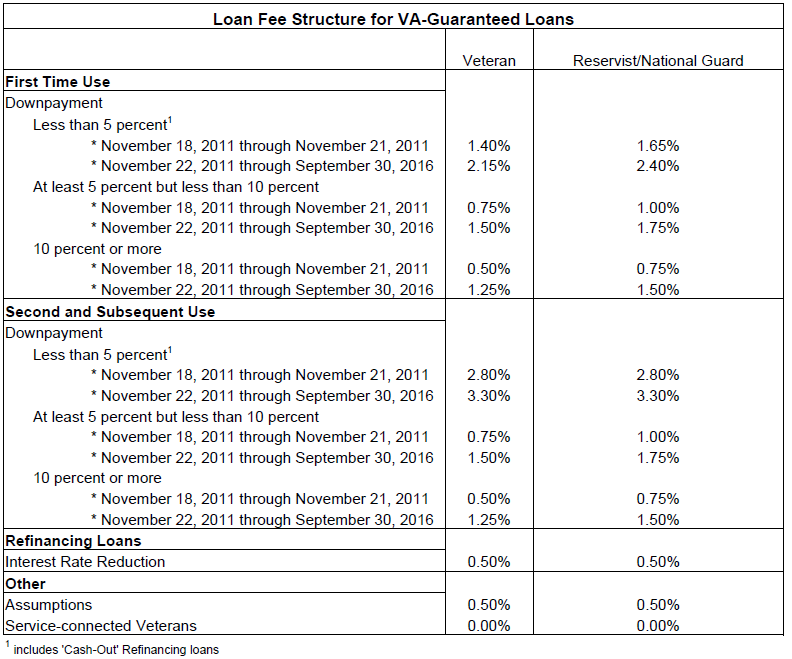

Rather, VA has included revisions to clarify the different forms of restrictions on participation in FHA programs encompassed by this section. Changes in this section replace certain references to the CARES Act with COVID-19. These changes align the scope of the COVID-VAPCP with the coordinated federal response to veterans' prolonged financial hardship, as discussed in section III.A. VA also agrees with commenters that the September 9, 2021 sunset date should be extended, given the potential for COVID-19 forbearances extending beyond that date. VA is adjusting the sunset date in the final rule to align with the expectation that no veteran will be in a COVID-19 forbearance after June 30, 2022. Review the VA funding fee rate charts below to determine the amount you’ll have to pay.

Will I have to pay the VA funding fee?

You should know that adding the VA funding fee and other loan costs to your loan could lead to you owing more money than the fair market value of the home. This could reduce the benefit of refinancing since your payment wouldn’t be as low as you may want it to be. It could also make it harder for you to get enough money out of the future sale of the home to pay off your loan balance. If you get a proposed or memorandum rating after your loan closing date, you’ll still need to pay the funding fee.

If you are approved for a VA funding fee refund post-closing and didn't write off the funding fee on your taxes, it shouldn't qualify as taxable income. However, if you did deduct the funding fee refund from your taxes, you would need to count the money you received from the refund as income. By writing off the funding fee refund, you reduce your overall taxable income. Lenders are not required to reduce the loan balance by funding fee amount financed into the loan.

Notice of Request To Release Airport Property

One commenter pointed out that VA's proposed rule creates “at least six discrete steps for a veteran to successfully qualify for a partial claim” which, in some cases, was more rigorous than existing VA loss-mitigation options. The name of the incumbent Secretary should not be included unless State law requires naming a real person. VA does not agree at this time to commit to accepting partial claim requests for at least 15 months beyond the date the COVID-19 national emergency ends. As the proposed rule explained, the COVID-VAPCP is intended as a temporary program. Thus, it is reasonable for VA to set a program sunset date that, at the time of this writing, aligns with federal guidance signaling that COVID-19 forbearances should end by June 30, 2022. Also under that guidance, servicers must assist veterans in bringing their loans current as they exit COVID-19 forbearances.

The cost of rule familiarization is $99.90 for each guaranteed loan servicer, including the small servicers. The PRA cost estimates vary across servicers depending on how many COVID-19 forbearance loans they service that either meet or could potentially meet COVID-VAPCP requirements. An internal assessment indicates that approximately half of VA-guaranteed loans in forbearance will reach 360 days of forbearance sometime during the months of May and June of 2021. However, as discussed above, VA has been a part of the coordinated federal response that extends protections for borrowers with federally backed mortgages. Given these additional protections, VA now anticipates that most veterans currently in a COVID-19 forbearance will remain in such forbearance until at least late June 2021.

Guaranteed loan means a loan guaranteed under chapter 37 of title 38, United States Code. The Catalog of Federal Domestic Assistance number and title for the program affected by this document is 64.114, Veterans Housing—Guaranteed and Insured Loans. In addition to the changes discussed above, VA is adopting the following revisions to address technical issues that arose when considering comments. These markup elements allow the user to see how the document follows the Document Drafting Handbook that agencies use to create their documents. These can be useful for better understanding how a document is structured but are not part of the published document itself.

For funding fee refunds issued on or before June 30, 2019, VA will not adjust, modify, or redirect payment of a funding fee refund, if it was made in accordance with the provisions of VA Pamphlet 26-7 in effect at the time of processing. Subject to paragraph of this section, the Secretary will not accept a request for a partial claim payment after the date that is 180 days after the date the COVID-19 national emergency ends under the National Emergencies Act, 50 U.S.C.161. On February 16, 2021, VA published guidance stating that VA expects servicers to approve initial COVID-19 forbearances if the request is made on or before June 30, 2021.

You may be eligible for a refund of the VA funding fee if you’re later awarded VA compensation for a service-connected disability. The effective date of your VA compensation must be retroactive to before the date of your loan closing. If the loan has been refinanced with another VA loan, provide the refund to the current servicer and direct the servicer to apply the refund to the principal balance of the loan.

This can happen if you're a Veteran and your exempt status can't be verified before your loan closes, you must pay the funding fee as if you were not exempt. This may include situations where your disability claim is still in pending status at the time of closing. Veterans with non-VA guaranteed home loans now have new options for refinancing to a VA-guaranteed home loan. These new options are available as a result of the Veterans’ Benefits Improvement Act of 2008.